While you’ll likely need a few more pennies than the spare change you’ll find in your couch, it doesn’t have to be rocket science to prepare your finances for a newborn. Starting small, and early, can help make a big impact on your little one’s future.

One of the most valuable things you can do to get ready for your baby is creating a budget that outlines monthly income and expenses. It’s important to consider any disposable income that might change in the coming year and check with your employer about their parental leave policies if any. Consult with your partner about if and who will be taking time off, and when. If both dad and mom are eager to get back to the office, you’ll want to consider the cost of childcare or a nanny within your expenses.

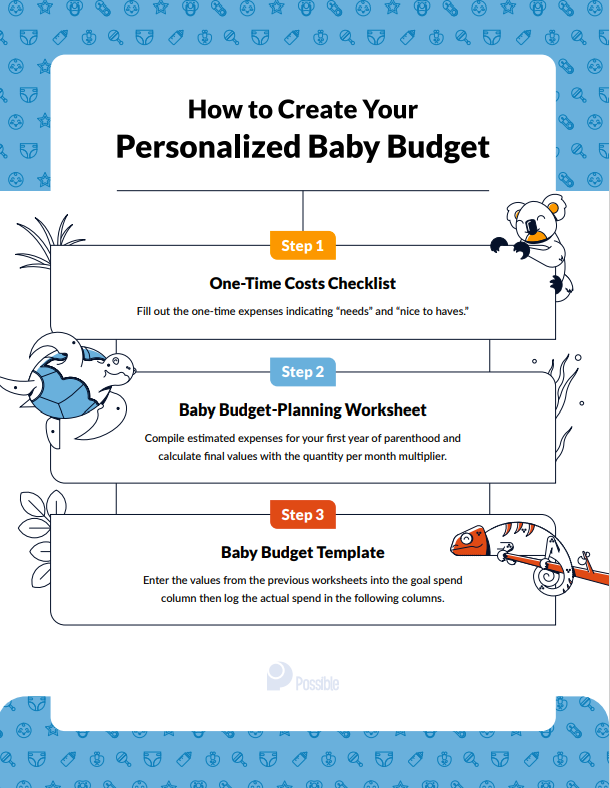

By creating a baby budget, you’ll have a good estimate of the costs that will come up, before they do. That will allow you to allocate more money to your savings or emergency funds. When you’re preparing your budget, consider the following basic expenses:

- Cost of check-ups (for mom, too!)

- Diapers

- Formula

- Car seat

- Stroller

- Baby clothes

- Childcare

- Toys

- Crib

As you’re budgeting, think of where you can save money — and what’s a non-negotiable expense. Things like car seats and strollers can be a gamble if purchased used, but baby clothes and toys should be perfectly safe after being sanitized. Your local thrift store will have plenty of baby books, some in mint condition, that are a perfect budget-option for new parents.

When you’re allocating your monthly spending towards necessities, think about the timeline your baby will need their new gear. Is there something you can hold off on purchasing for a few months to save additional emergency money?

At the end of the day, how you allocate your finances is completely up to your discretion, but thinking about your month-to-month spending will better help you when your baby arrives, and give you peace of mind throughout your pregnancy.