I received the product below to review in exchange for sharing my honest opinion.

It’s that time of the year again that people either love or hate: Tax time. I honestly don’t mind tax time and being the crazy paperwork loving person that I am, I love to do it myself. Ever since I started doing my own taxes I have been using TurboTax. From when I was single with just one job, to married with multiple jobs, kids, investments and a house. Oh and of course business since I’m technically self-employed.

What I love about TurboTax is the simplicity of it. You really can’t make a mistake with TurboTax, unless of course its user error of forgetting to put something in or putting the wrong numbers in. TurboTax asks all the questions and even double checks with other questions. “Did you get married?” “Do you own a house?” “Do you have investments?” and so forth.

I have used both TurboTax from a CD and the online version. This year TurboTax online has a few new features included and that is the version I will be using.

Snap. Tap. Done. ™: Gives customers filing on a computer, smart phone or tablet a jump start on their taxes with a snap. Customers simply snap a photo of a W-2 and TurboTax will automatically put their information directly into their tax return. In addition, TurboTax securely imports tax information directly from more than 1.4 million employers and financial institutions, eliminating data entry and increasing accuracy for effortless tax preparation.

SmartLook ™: Gives customers personalized answers when they need them by connecting them with live TurboTax experts using one-way video technology. Exclusively through TurboTaxSmartLook, customers can quickly connect with TurboTax experts who answer questions in real time – completely free. TurboTax experts can also highlight key fields and next steps on the screen for customers so they can complete their tax return with confidence. With just a click, customers can benefit from a second pair of eyes on their tax return so they never feel alone.

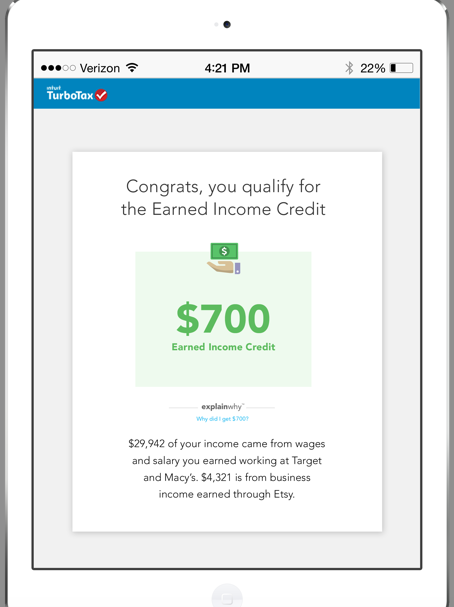

ExplainWhy ™: Gives customers personalized, bite-sized explanations of the why behind their deductions, credits and tax refund, so they can be confident they are getting every dollar they deserve. Whether customers have questions about what filing status to claim, or if they are eligible for the Earned Income Tax Credit or Child Tax Credit, TurboTax ExplainWhy instantly provides them with explanations tailored to their specific tax situation. Now customers can quickly and easily understand what’s going on with their refund, so they can be confident their taxes are done right.

For me using TurboTax is super easy since I’ve used it in the past, it will just pull all my information from previous years. Never fear though if you haven’t used TurboTax before as it is really easy to input your information and even download statements into it.

As you go, TurboTax asks questions and you can even watch your Refund go up or down. I like seeing how different numbers I input make a difference.

You input your Personal Info, Federal Taxes info and State Taxes Info. Worried you are missing something? You can easily use the Search feature. I like to organize all my statements and one by one input them and check them off, literally I put a checkmark in the corner so I know I inputted it already. If you want extra help and assurance you can even upgrade your tax package to include extra Audit Defense, Priority Care and more.

You can even do your State Taxes in TurboTax by answering just a few more questions.

I like too that it gives me an estimate of my Audit Risk based on “based on an analysis of some common situations in your tax return and, where possible, provide simple guidance to make sure that your return is correct.”

Last year 31 million people used TurboTax to file their taxes, so I’d say they are definitely doing right! I have told countless friends and family members about how easy and convenient TurboTax is and I really do mean that. You can have TurboTax guide you with questions or just work on everything you’d like by just clicking on the topic. I like to have it guide me so I don’t miss anything. Oh and you can work on TurboTax on your smartphone, tablet or desktop!

Stay Connected with TurboTax:

TurboTax WEBSITE | TurboTax FACEBOOK | TurboTax TWITTER | TurboTax PINTEREST

BUY IT: Check out TurboTax online or find it at your local mass retailer! The boxes explain too which is the right version for you but for average consumers, TurboTax Deluxe is usually perfect!

WIN IT: (2) US winners will receive a free code for TurboTax Premier 2015 on Turbotax.com

Need help entering a giveaway? Check out my blog post for some help!

GIVEAWAY ENTRY:

a Rafflecopter giveaway

This Giveaway Ends February 15, 2016.

Betty C says

I love using TurboTax. It’s always so easy.

Stephanie o'day says

I typically use Turbo Tax!

Thomas Murphy says

I do my taxes online.

Jerry Marquardt says

I was using H & R Block, but it is getting too expensive to do it.

Richard Hicks says

I have been using turbo tax for several years!

Michael Perkins says

Ive used TurbiTax for the last several years

DJ says

You rock!

Mr. S. BARMAN says

Usually do taxes manually on paper.

Anne says

My spouse does our taxes, and he usually waits until the last minute, which leaves me with a lot of anxiety during early April (will he do it? when?). He does use TurboTax.

Carole Spring says

For the last few years I have used TurboTax and I love how simplifies doing one’s taxes.

Crystal W says

I’ve always used a program like Turbo Tax or Tax Cut for mine. I miss how easy it was when I just had one job, though, instead of being freelance!

Julie Matek says

We typically use turbo tax to do our taxes:) thanks for the chance!

Angela Saver says

We typically take our taxes to a local accountant!

LL says

usually try to use free versions of tax programs

Andrea v says

We usually take our taxes to a local accountant

Tara says

I typically do taxes with Turbo Tax!

Wanda Banks says

H&R Block typically does our taxes.

Lisa says

I use to go to H&R block but am going to try to do it on my own.

BusyWorkingMama says

I’ve used TurboTax for years to do my taxes, and I’m a CPA!

pu ye says

We usually use the free version of Tax Act online. It’s free for federal returns

Sharon Kaminski says

We like to use turbo tax to submit our taxes.

Gayle Watkins says

I do our taxes using TurboTax Premium edition. I have used it for years. Ain’t gonna lie – if you have more than just the basics, it takes some time. But, they give you tons of help. And, you don’t have to pay the tax guy $500 and you have the satisfaction of doing it yourself!

Chetyl b. says

I take it to an accountant.

Karen says

We usually use the free version of Tax Act online. It’s free for federal returns and cheap for state returns. So far, they’ve been great!

cheryl s says

we usually go to B&R Block for our taxes

sandra says

we actually use turbo tax, though I don’t know which edition

Mia says

I typically use Turbo Tax to do my taxes.

Natalie says

I typically do my taxes on my own through either Turbo tax or H&R Block.

laura feist says

i like the simplicity of turbo tax

Julie Lundstrom says

I usually go to H & R Block to have them done.

Nancy Burgess says

Very informative thanks!

Mami2jcn says

I always use Turbotax! It makes things simple.

Abigail says

My accountant sister in law usually does ours but Im not so sure she’s excited to keep doing it for us!!